Refinance appraisal higher than expected? A complete guide

Refinance appraisal higher than expected? Understand the appraisal process, associated costs, and what it means for your refinancing options and mortgage terms.

Read more

Refinance appraisal higher than expected? Understand the appraisal process, associated costs, and what it means for your refinancing options and mortgage terms.

Read more

Here are the counties where mortgage payments have jumped the most in the past 2 years.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

Can I use a 401 (k) to buy a house without regrets? Learn how it works, what it costs, and whether this strategy fits your homebuying goals and timeline.

Read more

A doctor and single parent, forced to downsize after divorce, navigates debt and damaged credit to provide a safe home for her family.

Read more

Why wait, save, and pay rent to your landlord when you could be paying off your own home. See why smaller down payments can unlock the door to homeownership.

Read more

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

Want to buy a home for the first time? More affordable homes are hitting the market now, giving first-time buyers more choices and a better shot at ownership.

Read more

A guide to navigating first time homebuyer loans, grants, and programs to make sure you get the most bang for your buck.

Read more

A new announcement from the Federal Reserve could mean the end of low rates—but that may not be bad news for buyers and homeowners.

Read more

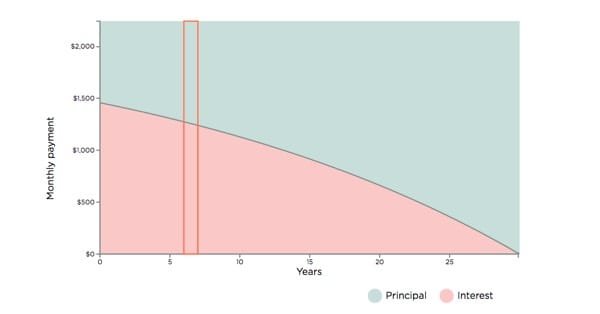

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

Can you still buy a home if you have student loan debt? Turns out you have some options. Here’s what you should know about getting a mortgage.

Read more

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

Home prices continue to rise, but the holiday season could spell opportunity for some. See multiple ways first-time buyers can get a competitive edge.

Read more

Buying your first home? Don’t fall into these 6 common mistakes. Get expert advice to help you make better choices from the start.

Read more

Learn how rising inflation influences current refinance mortgage rates, where they may be headed next, and why acting fast could save you money.

Read more

Ready to buy a home? Learn how to get serious about your house hunt with practical tips on budgeting, pre-approval, and navigating a competitive market.

Read more

Homebuyers are paying more at closing than they did in 2020, but choosing the right lender and loan options can help you save on a new home.

Read more

Closing costs are going up around the country, but choosing the right lender can help you save more on a new loan.

Read more

Learn how to win a real estate bidding war in a competitive market by understanding contingencies, using smart offer tactics, and proven strategies that work.

Read more

Need something else? You can find more info in our FAQ